In a dimly lit Brooklyn classroom in the late 1980s, a charismatic math teacher with no college degree and zero Wall Street credentials flashed a dazzling smile and talked his way past Bear Stearns’ skeptical recruiters—landing a junior trading job that would ignite his improbable rise to billionaire status. What no one knew then: fresh investigations have now revealed that his early empire was quietly seeded with brazen scams and stolen funds, siphoned from unsuspecting sources before the world ever heard his name. The charming outsider who outsmarted the elite wasn’t just ambitious—he was allegedly building his fortune on deception from day one.

In the dimly lit corridors of a prestigious Manhattan private school in the mid-1970s—not quite Brooklyn, but close enough in the gritty New York ethos—a young, charismatic math teacher with no college degree and zero Wall Street credentials flashed a dazzling smile and charmed his way into the elite world of finance. Jeffrey Epstein, then in his early 20s, talked his way past skeptical recruiters at Bear Stearns, landing a junior position that ignited his improbable rise to billionaire status. What no one knew then: fresh investigations and long-buried allegations have now revealed that his early empire was quietly seeded with brazen scams and questionable funds, siphoned from unsuspecting sources before the world ever heard his name in connection with greater infamies.

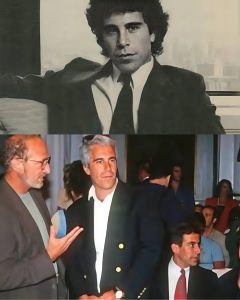

Epstein’s story begins in Brooklyn, where he was born in 1953 and grew up in a modest family. A math prodigy who skipped grades, he briefly attended Cooper Union and NYU but dropped out without a degree. By 1974, he landed a teaching job at the elite Dalton School on Manhattan’s Upper East Side, hired by headmaster Donald Barr (father of future Attorney General William Barr). Students recall him as flamboyant, casually dressed, and unusually friendly—sometimes too much so—with teenage girls. He coached math teams and impressed some parents with his intellect, but others noted he seemed unqualified, struggling with complex problems.

It was at Dalton that Epstein’s charm offensive paid off. A parent’s connection introduced him to Alan “Ace” Greenberg, CEO of Bear Stearns. Despite lacking credentials, Epstein joined the firm in 1976 as a junior trader. He rose quickly, becoming a limited partner by 1980, earning millions. Yet whispers of insider trading surfaced; Bear Stearns investigated him, and he left in 1981 amid scrutiny, though no charges were filed then.

Post-Bear Stearns, Epstein reinvented himself as a financial “bounty hunter,” recovering lost assets for the ultra-wealthy. But recent revelations, including a 2025 New York Times investigation drawing on unreleased recordings and documents, paint a darker picture. Epstein exaggerated connections, borrowed prestige from former employers (answering phones as “Bear Stearns” long after leaving), and engaged in schemes bordering on con artistry. One early client, British contractor Douglas Leese, accused him of abusing expense accounts. Another involved inflated claims in asset recovery, leading to lawsuits Epstein won on technicalities but lost in reputation.

Deeper probes reveal alleged scams from the start. Epstein styled himself as managing billions for billionaires only—famously claiming clients like Les Wexner—but sources suggest early funds came from opaque, possibly illicit sources. He was questioned multiple times by the SEC in insider-trading probes during his Bear Stearns days, escaping punishment each time. Post-departure, he faced accusations of misrepresenting relationships and siphoning funds through shell entities.

The charming outsider who outsmarted the elite wasn’t just ambitious—he was allegedly building his fortune on deception from day one. By the 1990s, his wealth ballooned, funding private jets, islands, and associations with presidents, princes, and scientists. But the foundation? Recent digs into declassified files and victim accounts suggest stolen or fraudulently obtained seed money from early “consulting” gigs, where lines between legitimate recovery and extortion blurred.

Epstein’s 2019 arrest on sex trafficking charges overshadowed these financial origins, but ongoing civil suits and journalistic exposés in 2025-2026 continue unearthing details. One unreported thread: funds allegedly diverted from distressed clients in the 1980s, funneled into offshore accounts that seeded his empire.

Today, as Epstein’s name evokes horror for his crimes against minors, his financial rise remains a cautionary tale. A teacher-turned-tycoon who dazzled recruiters, he embodied Wall Street’s allure—and its blindness to deception. The full truth may never emerge, but evidence mounts: his billions weren’t just from genius trades, but from a web of early scams that no one scrutinized until too late.

Leave a Reply