Picture this: a credential-free Brooklyn dropout with no Wall Street pedigree waltzes into Bear Stearns in the late 1970s, charming executives into handing him a trading role—only to quietly engage in shady deals, expense abuses, and insider violations that force his abrupt exit in 1981. For decades, Jeffrey Epstein spun this improbable leap into a legend of sheer genius, a self-made billionaire whispering financial wisdom to the world’s elite. But emerging evidence from a bombshell 2025 New York Times investigation is quietly shattering that myth, exposing a calculated trail of financial manipulations, ruthless scams, stock schemes, and misappropriated funds starting at Bear Stearns and stretching far beyond—revealing the shadowy money master as a serial deceiver who built his empire on lies and cons.

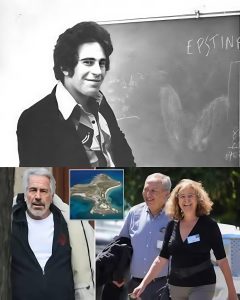

Picture this: a credential-free Brooklyn dropout with no Wall Street pedigree waltzes into Bear Stearns in the late 1970s, charming executives into handing him a trading role—only to quietly engage in shady deals, expense abuses, and insider violations that force his abrupt exit in 1981. Jeffrey Epstein, born in 1953 in Coney Island to a working-class family, skipped grades as a math prodigy but left college without a degree. By 1974, he was teaching physics and math at Manhattan’s elite Dalton School, despite lacking qualifications. There, his charisma caught the eye of a student’s parent, who introduced him to Bear Stearns CEO Alan “Ace” Greenberg. Hired in 1976 as a junior trader, Epstein rose swiftly to limited partner by 1980, earning millions amid the firm’s booming options desk.

But cracks appeared early. In 1981, amid an SEC probe into insider trading linked to a Seagram tender offer for St. Joe Minerals, Epstein departed abruptly. Though no charges were filed against him or the firm, colleagues later recalled irregularities, including expense abuses and a possible “Reg D” violation for lending money to a friend to buy stock. Epstein claimed he left voluntarily to go independent, but the timing fueled speculation of deeper misconduct.

For decades, Epstein spun this improbable leap into a legend of sheer genius—a self-made billionaire whispering financial wisdom to the world’s elite, from presidents to princes. He founded firms like J. Epstein & Co., claiming to manage billions exclusively for the ultra-wealthy, owning islands, jets, and mansions. His closest tie was to retail mogul Les Wexner, who granted him power of attorney and vast control over finances in the 1980s and 1990s.

Emerging evidence from a bombshell December 2025 New York Times investigation, titled “Scams, Schemes, Ruthless Cons: The Untold Story of How Jeffrey Epstein Got Rich,” is quietly shattering that myth. Drawing on unreleased recordings, archives, interviews, and documents, reporters David Enrich, Steve Eder, Jessica Silver-Greenberg, and Matthew Goldstein reveal a calculated trail of financial manipulations, ruthless scams, stock schemes, and misappropriated funds starting at Bear Stearns and stretching far beyond.

Key revelations include Epstein scamming video-game executive Michael Stroll out of most of a $450,000 investment in a phony oil deal. He posed as a “bounty hunter” recovering stolen assets, but only one major case is verified—yet it yielded huge fees under questionable claims. He falsely claimed affiliations, like working for hedge funds, and abused client expenses. With Wexner, Epstein gained extraordinary access, later accused of diverting vast sums through offshore entities. He borrowed Bear Stearns’ prestige for years post-departure, exaggerating connections to lure targets.

The investigation concludes Epstein wasn’t a trading savant but a master manipulator who lied, stole, and ripped off people from the start. Early windfalls from cons made him a millionaire, enabling bigger marks. His wealth funded a network that insulated him from scrutiny until his 2019 sex-trafficking arrest and death.

This probe, based on exhaustive research, exposes the shadowy money master as a serial deceiver who built his empire on lies and cons. While Epstein’s crimes against minors dominate his infamy, the financial origins reveal a lifelong pattern of deception in elite circles—a cautionary tale of unchecked grift amid Wall Street’s glamour.

Leave a Reply