She was barely out of high school when the invitations began—private flights, glittering parties, and the promise of a future that vanished the moment the bedroom door locked. For more than a decade she carried the weight of that betrayal in silence, convinced no one would ever believe her, let alone make it right.

Then the money started arriving.

From the Epstein estate’s $121 million Victims’ Compensation Fund, more than 135 survivors finally received acknowledgment in dollars. But the real shock came when Wall Street’s giants stepped forward: JPMorgan Chase paid $290 million to settle claims it ignored red flags for years, and Deutsche Bank followed with $75 million for similar accusations of turning a blind eye. Together, these hundreds of millions expose a chilling truth—the world’s most powerful banks didn’t just bankroll Jeffrey Epstein; they helped keep his nightmare machine running.

So if the silence was worth this much, what else did they know—and who else stayed quiet?

She was barely out of high school when the invitations began—private flights to exotic islands, glittering parties filled with powerful names, and the promise of a modeling career that would change her life. That future vanished the moment the bedroom door locked behind her. What followed was years of coercion, violation, and shame she carried alone, certain that no one would believe a teenage girl against a man who moved in circles of presidents, princes, and billionaires.

For more than a decade, the silence was absolute. Then the money started arriving.

In 2021, the Epstein Victims’ Compensation Fund, funded entirely from Jeffrey Epstein’s estate, distributed over $121 million to more than 135 survivors. The program, which closed after reviewing hundreds of claims, offered payments ranging from six figures to multi-million-dollar awards, calibrated to the severity and duration of the abuse each woman endured. For many, the check represented the first official recognition that their suffering had been real, criminal, and not their fault.

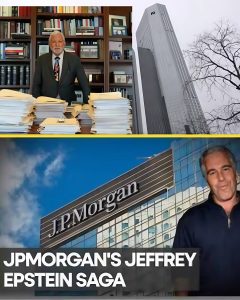

But the larger reckoning came from the institutions that had long profited from Epstein’s wealth. In 2023, JPMorgan Chase agreed to pay $290 million to settle a class-action lawsuit filed by his victims. The bank never admitted liability, yet court documents and internal communications made the pattern undeniable: for nearly two decades, JPMorgan managed Epstein’s accounts while ignoring—or willfully overlooking—numerous red flags. Frequent large cash withdrawals, wire transfers to dozens of young women, payments to known recruiters—these were not isolated anomalies but a steady stream of suspicious activity that compliance officers flagged and then ignored.

Deutsche Bank, which took over Epstein’s business after JPMorgan severed ties in 2013, settled its own claims for $75 million the following year. Like its predecessor, the German bank was accused of failing to act on obvious warning signs, allowing Epstein continued access to the financial infrastructure that sustained his trafficking operation.

Together, these three sources—the estate fund, JPMorgan, and Deutsche Bank—have channeled more than $486 million directly to survivors. The money has funded therapy that lasts years, covered medical bills, paid down debts incurred during periods of instability, and in some cases allowed women to move to new cities where the past feels less present. For many recipients, the financial relief has been life-altering, offering stability and breathing room after decades of trauma.

Yet the scale of the payouts also illuminates the depth of institutional failure. These were not small regional banks; they were among the most powerful financial institutions on earth. Their silence was not ignorance—it was a choice, repeated over years, that helped keep Epstein’s network operational and his victims isolated.

The settlements mark a rare instance of Wall Street being held financially accountable for enabling sexual exploitation. They force a partial reckoning: the same system that once protected the powerful has now been compelled to pay a steep price for looking away. While the dollars cannot restore what was stolen, they stand as tangible proof that complicity carries consequences—even for those who once believed themselves untouchable.

Leave a Reply