She was just 17 when the private jet landed, when promises of modeling gigs turned into locked doors and hands she couldn’t escape. For years she carried that terror alone—until the money started arriving, not as apology, but as consequence.

In a landmark settlement, JPMorgan Chase agreed to pay $290 million to victims of Jeffrey Epstein, admitting no wrongdoing but acknowledging it had ignored glaring red flags while managing his accounts for over a decade. This massive payout joins the $121 million already distributed by Epstein’s estate to more than 135 survivors through the Victims’ Compensation Fund—money meant to recognize the pain of girls and women he exploited with impunity.

Together, these hundreds of millions represent one of the largest financial reckonings in a sex-trafficking scandal that ensnared the powerful. Yet the same question haunts every survivor and observer: If the banks saw the warning signs and looked away for so long, how many more enablers are still walking free?

She was just seventeen when the private jet touched down. What began as whispered promises of modeling contracts and a glamorous future quickly became locked bedroom doors, hands she could not push away, and a terror that would follow her for decades. Like so many others, she carried the weight of that violation in silence, convinced no one would believe her, that the powerful man who orchestrated her abuse was untouchable. Then the checks began to arrive—not as apologies, but as consequences.

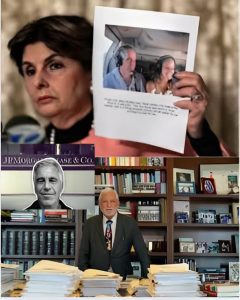

In June 2023, JPMorgan Chase agreed to pay $290 million to settle a class-action lawsuit brought by victims of Jeffrey Epstein. The bank admitted no wrongdoing, yet the agreement acknowledged a painful truth: for more than fifteen years, while managing Epstein’s accounts, JPMorgan ignored a cascade of red flags. Suspicious transfers to young women, large cash withdrawals, payments to individuals later identified as recruiters—all documented, all overlooked. Internal emails later revealed employees referring to Epstein’s behavior with dark humor, yet no one intervened until the scandal became impossible to ignore.

This $290 million settlement joins the $121 million already distributed by the Epstein Victims’ Compensation Fund, established from Epstein’s estate after his death in 2019. That fund paid more than 135 survivors, with awards ranging from hundreds of thousands to several million dollars depending on the severity and duration of the abuse. Together, these two sources alone represent over $410 million in direct payments to women and girls who were exploited in Epstein’s vast trafficking network—a network that relied on wealth, connections, and institutional indifference to operate for years.

The money has changed lives in tangible ways. Survivors have used the funds for long-term therapy, to pay off debts accumulated during years of instability, to relocate far from places that trigger memories, and in some cases, to support their own children who grew up carrying secondary trauma. For many, receiving the payment felt like the first public acknowledgment that what happened to them was real, criminal, and not their fault.

The financial reckoning also exposed the depth of institutional failure. If one of the world’s largest banks could witness the warning signs—repeatedly—and choose silence for profit, the circle of complicity extends far beyond Wall Street. Private aviation companies, modeling agencies, real-estate brokers, and elite institutions that accepted Epstein’s donations all played roles in enabling his access and power. The settlements force a measure of accountability, but they also highlight how many enablers remain untouched by any consequence.

These payouts stand among the largest ever secured in a sex-trafficking case involving figures of such influence. They provide breathing room, resources, and a measure of dignity to women who were once dismissed and discarded. The funds cannot undo the damage, but they mark a shift: from invisibility to recognition, from silence to consequence. For the survivors, each check is proof that the system, however belatedly, has been made to answer—at least in part—for looking away.

Leave a Reply