He opened the envelope in a quiet apartment far from any island, hands shaking as he read the figure: seven digits, wired from a dead man’s estate. It wasn’t gratitude he felt—it was rage. The same financial machinery that once laundered Jeffrey Epstein’s darkest secrets was now being forced to pay for the wreckage it ignored.

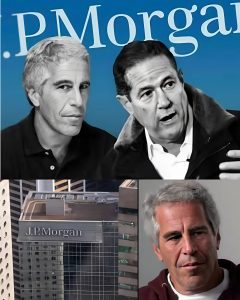

Massive compensation invoices continue to surface in the unsealed Epstein files: the estate’s $121 million distributed to survivors, JPMorgan’s blockbuster $290 million settlement for looking the other way, and tens of millions more from other institutions. Billions in suspicious transactions—private jets, mystery wires, unexplained transfers—once fueled a predator’s empire. Now those same streams of tainted money are being redirected, compelled by courts to fund healing instead of horror.

But as the checks clear and the numbers climb, one question burns louder than ever: Who else handled the money—and how much more is still hidden?

He opened the envelope in a quiet apartment far from any island, hands shaking as he read the figure: seven digits, wired from a dead man’s estate. It wasn’t gratitude he felt—it was rage. The same financial machinery that once laundered Jeffrey Epstein’s darkest secrets—billions in suspicious transactions, private jets, mystery wires, unexplained transfers—was now being forced to pay for the wreckage it ignored.

The Epstein Victims’ Compensation Program, established from his estate after his 2019 death, distributed more than $121 million (with some reports citing up to $125 million) to over 135–150 survivors before closing in 2021. These payments provided direct relief for stolen childhoods, funding therapy, debt relief, and stability after years of trauma.

But the estate’s funds were only the beginning. In 2023, JPMorgan Chase—the bank that serviced Epstein from 1998 to 2013—settled a class-action lawsuit for $290 million, addressing claims that it repeatedly ignored red flags like large cash withdrawals and transfers to young women tied to his trafficking network. Separately, JPMorgan paid $75 million to the U.S. Virgin Islands to resolve related allegations of facilitating his crimes.

Deutsche Bank, which took over Epstein’s accounts from 2013 until around 2018, settled its own class-action claims for $75 million in 2023, with victims eligible for awards up to several million dollars each. The U.S. Virgin Islands also secured over $105 million from the estate in 2022, including cash and half the proceeds from the sale of Little St. James—the private island central to many abuses—which sold for $60 million in 2023, adding roughly $30 million more to victim support and anti-trafficking efforts.

These sources alone push total restitution well past $500 million, with funds redirected from the very streams that once fueled Epstein’s empire toward healing. Survivors have used the money for long-term mental health care, relocation from triggering environments, and support for families carrying secondary trauma. The settlements also include provisions for charitable organizations, law enforcement enhancements against human trafficking, and community recovery programs.

The financial reckoning is historic, exposing how major institutions profited from Epstein’s wealth while overlooking—or willfully ignoring—clear signs of exploitation. Internal records later revealed warnings dismissed, compliance failures repeated, and relationships maintained for lucrative fees. What was once currency of concealment is now compelled by courts to fund restitution instead of horror.

Yet the numbers, staggering as they are, highlight an ongoing reality: the full network of enablers extends beyond these banks. Private aviation firms, modeling agencies, real-estate entities, and other high-profile figures handled Epstein’s money and movements for years. Unsealed documents continue to reveal layers of transactions and associations, suggesting more accountability may still emerge through litigation or investigations.

The checks clearing today represent a forced redirection—money that once shielded a predator now compelled to acknowledge and address the harm. They offer survivors tangible support and a measure of validation, proving that institutional silence carries a steep price. While no sum can erase the rage or restore what was lost, these payouts mark a shift from impunity to consequence, turning the machinery that enabled abuse into a tool for recovery and prevention.

Leave a Reply